Severe accounting errors caused by spreadsheet mistakes

Minor accounting errors have a tendency to snowball and cost companies a significant amount of time, resources and business productivity. When employees make mistakes in important programs like financial spreadsheets, even a small blunder like a forgotten decimal point or misplaced digit could end up ruining plans and reputations.

Fortune highlighted some examples of major corporations that made huge accounting mistakes due to problems with Microsoft Excel. In one story, a loan company overreported profits by $1.3 billion. Another incident involved politicians quoting a research paper on global finances that accidentally excluded five countries from the final numbers.

These mistakes cause embarrassment and more dire consequences when companies operate with incorrect finances or federal regulators discover misreporting. Errors in Microsoft Excel and other spreadsheets are not uncommon, and companies must take steps to safeguard against regular accounting errors.

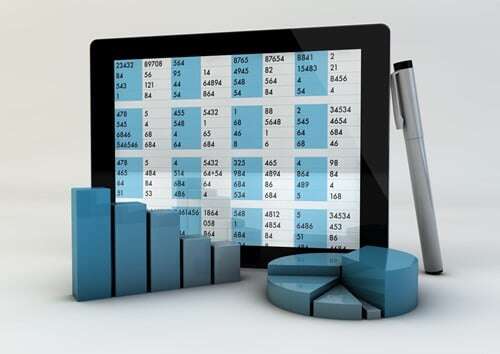

Spreadsheet errors are a frequent occurrence

In 2008, The University of Hawaii performed a massive analysis of numerous financial studies that concluded almost 90 percent of all spreadsheet documents contain errors, according to MarketWatch. The final report included everything from household budgets to the ledgers of major corporations. The researchers discovered data entry mistakes and improper balances were the norm rather than outliers.

In recent years, numerous business reports have found accounting errors in financial programs is still rampant. Business Insider shared the results of a F1F9 financial survey that found 16 percent of companies in the U.K. reported more than 10 instances of inaccurate spreadsheet data in 2014. One-third of respondents said accounting errors in spreadsheet formulation lead to bad business decisions.

Many large industries rely on financial spreadsheets when plotting future activities and reporting business success. The University of Hawaii and F1F9 reports found spreadsheet errors cost companies large amounts of capital and consumer confidence.

The common causes of spreadsheet misinformation

There are numerous reasons spreadsheets could contain incorrect data. PC & Tech Authority suggested most mistakes stem from a combination of inflexible programs and user errors.

The F1F9 report discovered 73 percent of respondents rely on spreadsheets for major business decisions but only one-third of companies provide employees with adequate training. All users who utilize spreadsheets for daily financial reporting or other accounting procedures need to use a consistent language for labels and other information details. Multiple users must have visibility into employee actions to ensure they don’t cancel each other out or create contradictory records.

If companies use multiple workbooks, they must create systems that are easy to use and supervise. Many problems in spreadsheet accounting grow more severe with a lack of data validation. When employees do make mistakes, companies need solutions that make errors visible immediately before they have a chance to misinform future procedures.

ERP services offer a unified solution

Companies may outgrow their current spreadsheet system and need new solutions for better visibility. A cloud-deployed or on premise ERP software program provides a unified approach to financial data entry.

ERP systems promote accurate performance from multiple users and automated processes to eliminate needless multiple re-entries that may provide opportunities for human errors. Reporting activities to a central database means supervisors can check numbers against projections and keep an eye on multiple records. If a company finds a solution with a customizable dashboard, it may create new, efficient strategies for scrolling through numerous datasets and comparing information.

IT Toolbox said many companies understand ERP solutions‘ ability to safeguard against data mistakes but are hesitant to implement due to reliance on old systems. Employees get stuck in routines and don’t want to adopt a brand new data system when they are unaware of the problems with their old procedures.

Businesses that want to eliminate mistakes in spreadsheets and other data procedures should investigate how Microsoft Dynamics or NetSuite ERP solutions could streamline financial information activities. Before reaching out to an ERP partner, employees who use spreadsheets everyday should communicate what they like about the current system and where improvements could be made. An organization wants to find an ERP consultant that can help guide implementation and provide performance metrics for initial training procedures to ensure workers utilize all of the advantages a centralized cloud-deployed solution can offer.